Less than Zero – the financial impact of the Coronavirus

Part 1 – How we got here.

The Daily Telegraph journalist Jeremy Warner provoked outrage on the 11th March, when said that Coronavirus could benefit the Economy because it would actually 'cull' (his words, not mine) those who will be a drain on resources – for example the elderly.

It was a strange week, because, what with the government talking about the UK population developing 'herd immunity' it felt like everyone had been watching far too many nature documentaries.

Mr Warner reasoned that Spanish flu had a 'lasting impact on supply' because it killed off 'primary bread-winners', which he said is unlikely to happen with Coronavirus.

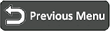

What the Telegraph journalist was driving at with his crass and insenstive statement, is the significant demographic shift with an ageing population and falling numbers of workers.

One of the worst cases of this is in Japan. By 2050, the OECD projects, nearly 40 per cent of Japan's population, will be elderly. This chart demonstrates the problem the journalist was alluding too.

On this part of the website we will be looking at how COVID 19 will affect your finances. We will be collating live market data and provide comments on what is taking place in the market. Watch this space over the comming days.

A few years ago, I went to a lecture at the LSE of the Economist Adam Tooze. I had just read his outstanding book 'Crashed: How a Decade of Financial Crises Changed the World'.

He told us back in 2018 that each time a crisis is solved, it returns with a vengeance. If you look at crashes starting with Long-Term Capital Management in '98, the .com crash of 2000, the financial account frauds of 2001 or the mortgage-backed securities driven financial meltdown of 2008, they have all been increasing in amplitude.

The big problem is that the Fed, the government, and the Central Banks, have to move heaven and earth each time to fix the problem.

Then within a few years, we're all acting like nothing awful happened. You have the problem of Moral hazard endemic in this industry. It's like a drug addict who keeps going back for more money- and keeps getting more from the government.

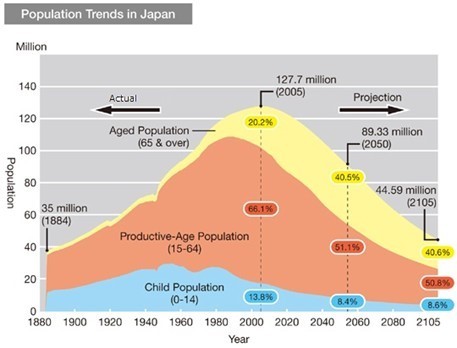

2008 - 'Too big to fail' - 2018 now they're even bigger

On this part of the website we will be looking at how COVID 19 will affect your finances. We will be collating live market data and provide comments on what is taking place in the market. Watch this space over the comming days.

Everyone still remembers the phrase 'too big to fail. Professor Tooze told us that, ironically, as a result of the government fixing the last crisis is that there are even fewer banks and that they are even larger than before.

But in 2008 something terrible happened and we were fortunate to get out of it. It cost a fortune - $13,000,000,000,000 (thirteen trillion dollars) of our (taxpayers) money and we're still suffering the consequences.

Federal Chairman Ben Bernanke said in 2008 that it was 'worse than the Great Depression' and but for the US Government's intervention, it would have been.

I had personal experience of this when living in Boston, USA, from 2005-2015. I used to meet up regularly with a senior director at a large financial firm, who was running the Mortgage-backed Securities Sales desk there. He used to laugh at his analyst projections and tell me they were complete rubbish.

Companies like Bear Stearns and Goldman Sachs were shorting (Betting against) Mortgage-backed securities while another part of the company was selling them.

I also knew the CEO of one of the companies that started the collapse, who was at the helm when this financial meltdown happened. He was distraught for a time as he thought he might go to prison. However, He walked away with no jail time and $30 Million in severance. Taxpayers had to bail out his company for $189 Billion.

Back in 2018, Professor Tooze told us that we are on a path of ever-greater fluctuation in Economic Downturns. In 2015-2016, we narrowly dodged a recession spreading from Russia, Brazil, South Africa, the collapse of commodity prices (notably, Oil) and the Chinese Yuan.

On this part of the website we will be looking at how COVID 19 will affect your finances. We will be collating live market data and provide comments on what is taking place in the market. Watch this space over the comming days.

He speculated that the crash could start in China. Five of the biggest eight banks are now Chinese. Growth in China has been slowing precipitously. The Trump US tariffs hurt the Chinese, and took their Economy from a standard 9% growth down to 6%.

But with this Coronavirus attack, their Economy is set to crash. They rely heavily on exports, and in the coming months, there will be a significant fall in demand.

But it's not just China that will be suffering. Italy was already in Recession before this pandemic hit them. Spain had youth unemployment at 50% before the pandemic. Greece is still reeling from the effects of the 2008 financial crash, mired in debt.

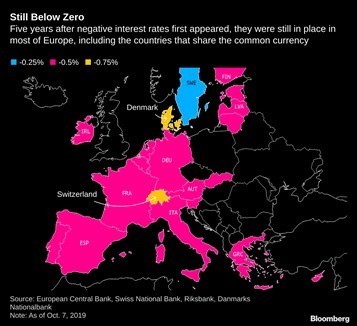

The big issue, that Professor Tooze said, is that we don't have any more room to go to fix the Economy. Every time we had a recession in the past, The Central banks would cut interest rates, which made it cheaper to borrow money.

On this part of the website we will be looking at how COVID 19 will affect your finances. We will be collating live market data and provide comments on what is taking place in the market. Watch this space over the comming days.

But already some Economies have negative interest rates, a twilight zone world where you have to pay the banks to take care of your money. They can’t reduce interest rates any more.

We were on Economic thin ice before this coronavirus epidemic hit. Now we have a global calamity no one could have conceived of. Do we have the resources to prevent an Economic collapse?

Help researchers help you!

- Share your opinion as your voice matters

- Help us understand everyone’s experience

- No bias, just science

- Help us improve future responses